I’ve made a lot of “mistakes” in my real estate investing experience.

I’ve also learned a lot.

(I’m sure I have a lot more to learn, too.)

One thing that FAR TOO MANY “newbie” real estate investors make (as did I) is that they have their “heads in the clouds”.

They don’t protect their downside.

They only imagine the gross rents that’ll roll in each month.

They imagine the ease of being a successful investor, with tenants paying down their mortgages and helping them build their wealth.

They often:

• Forget about “surprise” maintenance that often comes up.

• Forget about the time to manage phone calls.

• Forget about the time to collect rent.

• Forget about the time to call contractors and negotiate.

• Forget about the time it takes in dealing with the city/county.

• Forget about the time it takes to get the proper licenses/permits.

• Forget about the time it takes to advertise during vacancy.

• Forget about the need to clean and paint after someone moves out.

• Forget that real estate taxes increase over time.

• Forget that they have to show the property and screen potential tenants.

Look, don’t get me wrong.

Real estate investing can be a phenomenal vehicle for building cashflow.

It’s also a phenomenal vehicle for building wealth.

But… think of successful investors:

Although they aim for success and positive returns, they protect their downside by often “shorting” their positions.

At least the smart ones do.

I see far too many investors with under-funded business bank accounts.

This is not smart. And they have no protection.

Before I share with you how to “short” your position as a real estate investor, let’s discuss numbers.

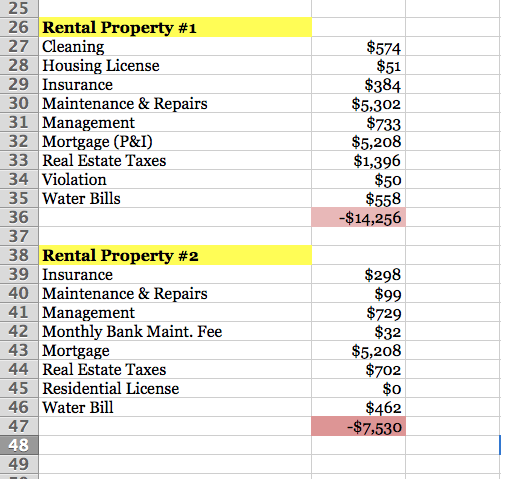

I own a few rental properties and here are some income and expenses from 2014.

These particular examples are two properties I have in a “rough part” of the city.

These are long-term buy and holds for me.

They are 3-bedroom homes and they rent for $700-$800/month.

I just finished my Year-to-Date (YTD) profit and less statement (P&L) for 2014 and I thought you’d be interested to see the expenses broken down for my two rentals.

Here were their expenses:

Some years expenses are higher than other.

Maintenance is a variable cost, and this can fluctuate.

This has made me realize my new goal of having a $10,000 minimum balance in each property’s bank account.

I want to prepare for when “surprises” happen.

It’s life, so they usually do.

For example, part of property #1’s maintenance expense being so high was the sewer line going to the street broke.

Best Choice Plumbing dug up the street and replaced it. Total = $3,200.

I’m sure I’ll have more repairs to make as time goes on.

For 2015, I’m focusing on building up the “maintenance funds”.

The Details

As often said, “The devil is in the details.”

Another mistake I often see is people over-simplifying real estate investing (and life for that matter).

Don’t over-simplify things that are detailed and complicated.

Get smart and get a grasp on the details.

There will most likely be MORE expenses than you realize when purchasing property.

I’m not trying to dissuade you from investing in real estate.

Not at all.

I just want you to enter the game with a bit more pragmatic intelligence than I did.

How to Protect the Downside

So how do you protect against the “downside” of real estate investing?

For one, move slower than you think necessary and think “downstream” about the expenses BEFORE you purchase your properties.

Have at least 1/10th – 1/12th the value of the house in the bank accounts.

Example: if your property is worth $100,000, retain an $8,000 – $10,000 balance at all times.

Be more pragmatic and less emotional before you buy.

Look at 20-30 (or more) properties before you buy.

Mike Summey, a successful real estate investor, refers to this as the “Threshold Theory”. He recommends you walk through the threshold of 40-50 properties before purchasing.

Now I know most people won’t do that…

Far too many look at 10 homes (or less) and then they buy. Don’t do that.

“Hit the streets” and get to know your desired neighborhood.

Study the price per square foot on the different types of homes (shells, “grandma” houses, rehabs, and new construction).

Use SOLD prices (not active or pending) and divide that by the square footage to get the price per square foot. This will help you look at property objectively.

For example, shells in your area might sell for $50-$60/square foot, while rehabbed homes are selling for $175/square foot. Not forgetting to account for carrying costs, commission, closing costs, and taxes, can you rehab that home for $55/square foot? Do you see how much easier the math can be when looked at like this?

Takeaways

I have a few friends who’ve “lost their shirts” in real estate.

When their houses got foreclosed on, they lost all motivation and drive to continue.

They hopped on the “emotional excitement train” of being a successful investor, they moved too quickly, they didn’t protect their downside, and they lost.

Don’t fall into that crowd, please.

Don’t fall for the “get _______ quick schemes.”

In my experience, my skills and knowledge have been built up slowly over time, with great attention to detail.

I didn’t make a lot of money fast.

I didn’t learn to build websites fast.

I didn’t learn the real estate game fast.

I didn’t learn to speak another language fast. (I’m still working on this)

And I didn’t learn how to track financials fast.

Again, it all took time.

The older I get, the more I realize that patience and details can really pay off.

(paradoxically, speed and hustle are also important, but I’ll save that topic for another time)

Stay sharp my friends.

Protect your downside, and not just in real estate.

Study the numbers.

Read books.

Hustle.

And pay attention to the details.

If not, they’ll swallow you up and overwhelm you to defeat.

Photo credit: Tomas Laurinavicius